The Loan Origination Solution manages loan application, underwriting and approval based on the workflows of our clients. Depending on product, loan amount, client type, application channel or other factors, the loan application can be routed through a specific workflow, and be approved by the relevant persons or Credit Committee.

Checks with Anti-Money Laundering blacklists or Credit Bureau can be set-up, and the solution be linked to a scoring system in order to automate partly or fully the credit decisioning process.

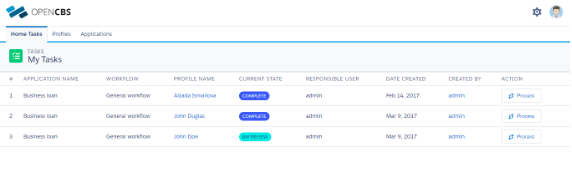

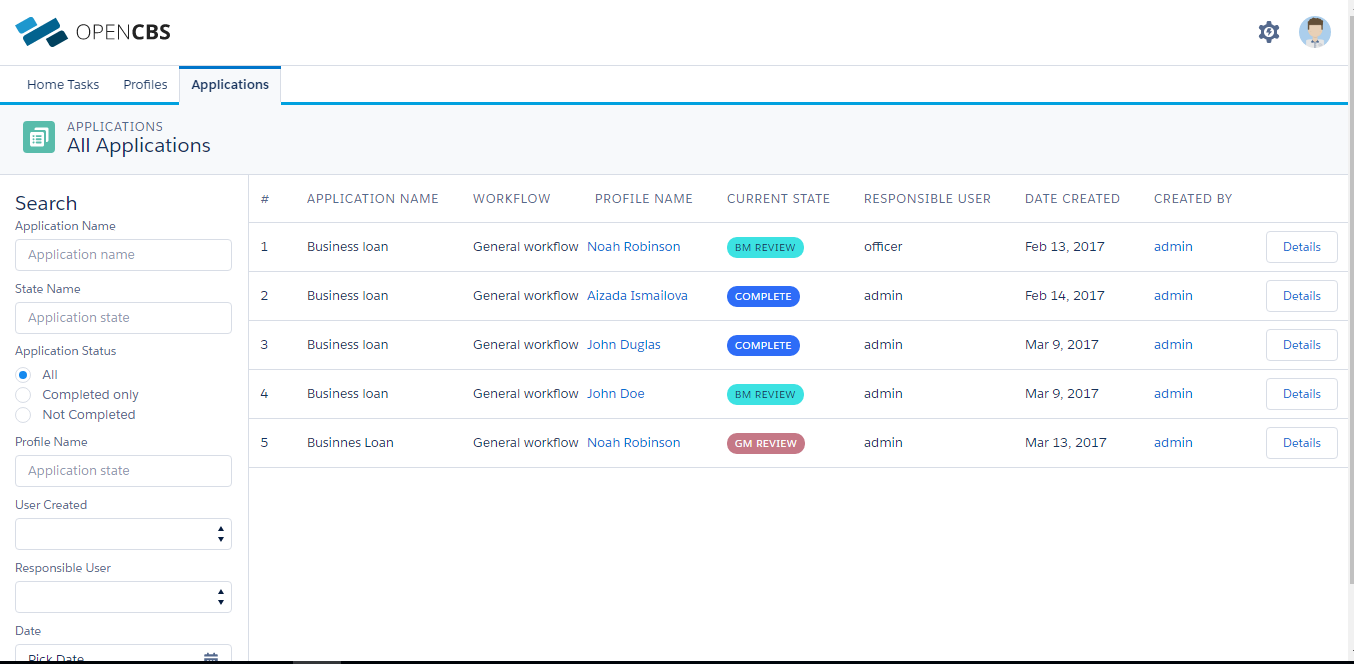

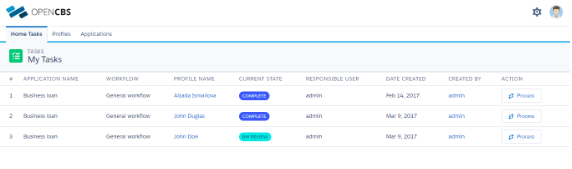

A task management interface allows the user to follow loans that are pending, sent for re-work or rejected, and have a clear view of the loans in the pipeline.

Combined with our Tablet Application, our Loan Origination Solution allows a complete digitisation of the Loan application and underwriting process, integrated with OpenCBS or a third-party Core Banking System.

Manage profiles and applications |

Use customised approval workflows |

||

|

|

Integrated task management |

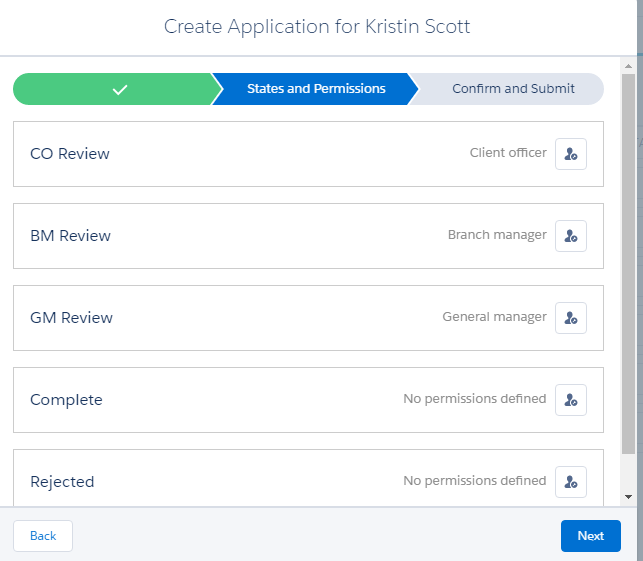

State and permissions |

|

|

|